Do you have a disaster recovery plan for your business? Because as much you do to avoid risk, something is bound to go wrong at some point. And whether it’s a cyber-attack, a flood, or a terrible review, you want to get your business back on its feet again as fast as possible.

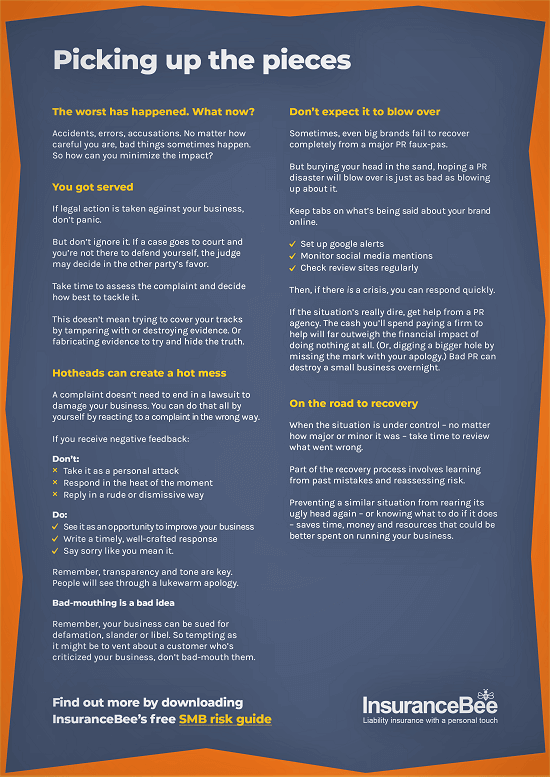

Picking up the pieces

Having the right insurance helps. Your insurer can manage a lot of the recovery process for you, freeing up your time and resources.

Say there’s a fire at your premises. If you have a commercial property policy your insurance company can take care of the renovation costs. And if you’ve taken out business interruption insurance, it can cover lost revenue.

Your insurers will arrange for the damage at your premises to be assessed, appoint contractors to handle the re-build, source replacement equipment, and cover lost income and wages.

Disaster recovery guide

But there are other steps you can take to minimize the impact of a disaster, too. You’ll find them in our handy cheat sheet. Taken from our Big Guide to Small Business risk, it’s the sixth in our series.

In it, you’ll find tips on:

• What to do if you got served

• How to handle complaints and negative feedback

• Recovering from a PR faux-pas

Plus, why bad-mouthing is a bad idea.

Feel free to download the other cheat sheets in our series. You’ll find them on our blog.

Guide to small business risk

And you might like to take a look at our risk guide.

There’s a whole chapter on getting your business back on its feet after a disaster, including some useful insight on online reputation management.

Click on the image to download.